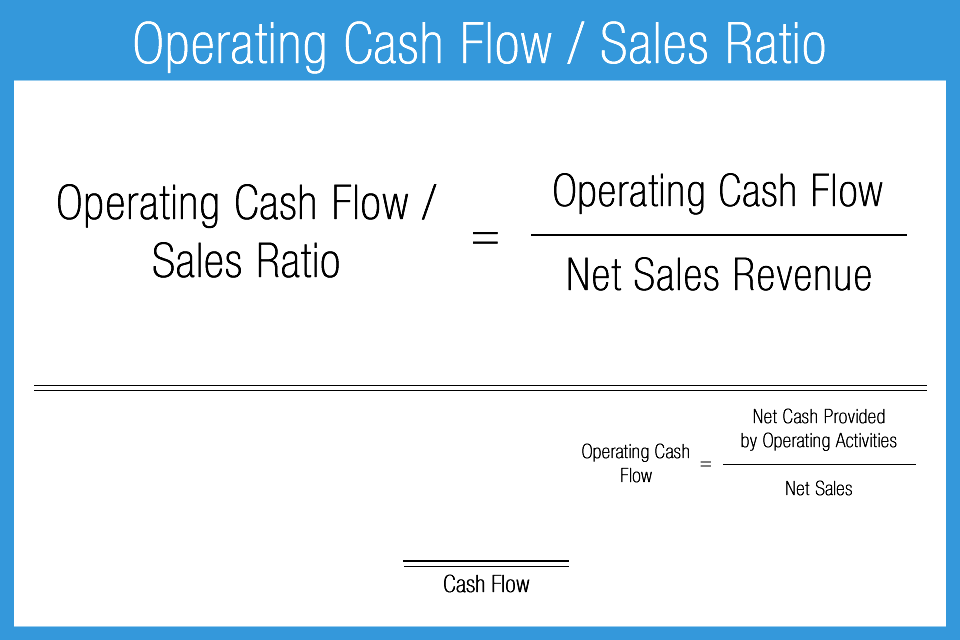

operating cash flow ratio importance

The operating cash flow of a company. The operating cash flow ratio is an important financial metric that comes in handy both for business owners and potential investors.

Balance Solvency Vs Liquidity For Your Business Pilot Blog Pilot Blog

It measures the amount of operating cash flow generated.

. The operating cash flow ratio is a measurement that indicates whether the cash created from continuing operations is sufficient. Operating cash flow is a financial metric that is often used to gauge the investment potential of a company. Why are cash flow ratios important.

For Year 3 -1100 450 -100 2400 1850 million. For best insights it should be used in conjunction. The operating cash flow is.

These can help measure the number of times a business can pay off its immediate debts with cash. Operating Cash Flow Ratio Definition. Its a measure of how.

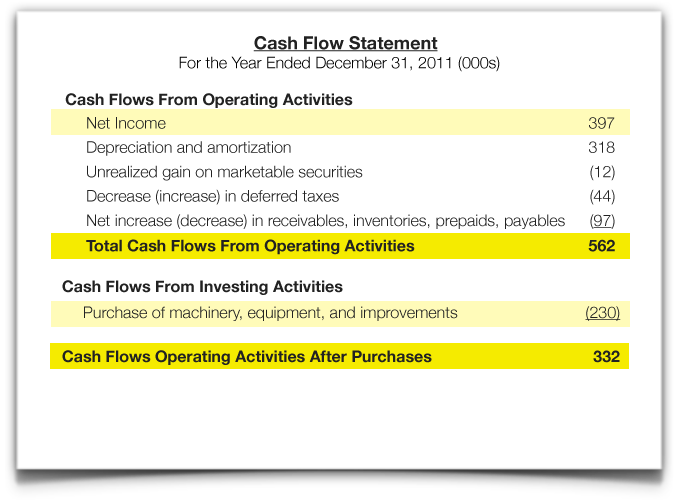

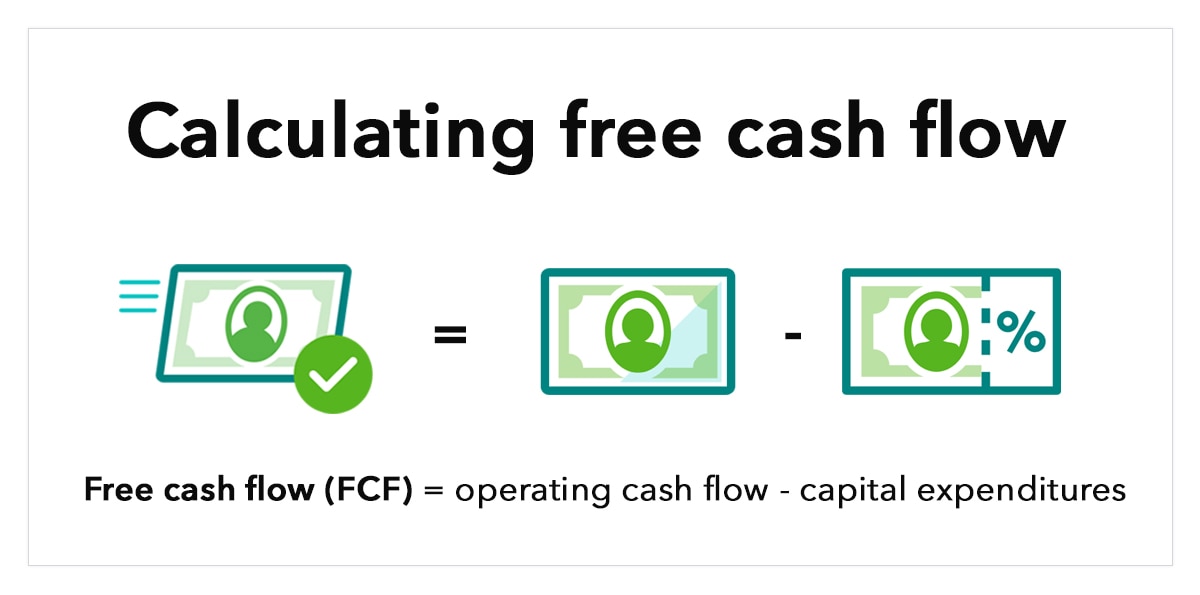

Calculating the free cash flow to sales ratio requires an additional step subtracting capital expenditures from operating cash flow. For starters the operating cash flow ratio shows the overall health of your businesshow much money it has managed to accumulate from its basic activities. How to calculate the free cash flow to sales ratio.

They use some ratios more frequently used than others depending on the business and its financial needs. The Operating Cash Flow Margin also called the Cash Flow Margin or simply the Margin Ratio is one of the most commonly used profitability ratios. Now let us put the figure of Operating Income so derived in the formula to calculate this ratio.

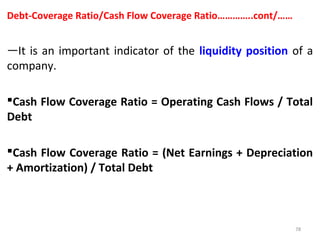

The Operating Cash Flow Ratio is a liquidity ratio its a measure of how well a company can pay off its current liabilities with the cash flow generated from its core business operations. Each ratio reveals a specific financial aspect of the company. Operating Cash Flow or cash flow from operating activities is the cash a company generates through the operations of its business.

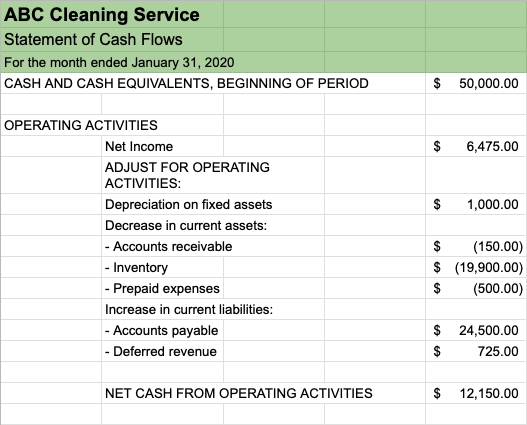

Ratios like- acid test ratio and operating cash flow ratio can help a lot. The operating cash flow ratio is a measure of how well current liabilities are covered by the cash flow generated from a companys operations. Operating Cash Flow Net Income - Changes in Assets and Liabilities Non-Cash Expenses.

The price-to-cash flow ratio is a valuation ratio useful when a business is publicly traded. We can use several ratios to learn more about. 100000 50000.

Operating Cash Flow Ratio. The Importance of Operating Cash Flow. We use the cash flow ratio to determine the companys overall financial performance.

Lets calculate Radhas store by using the indirect method.

Net Cash Flow Formula Calculator Examples With Excel Template

Your Money How To Evaluate Cash Flow Management Efficiency The Financial Express

Operating Cash Flow Ratio Finance Reference

5 Important Ratios For Effective Cash Flow Analysis Elm

Cash Flow Ratios Accounting Play

Constructing A Capital Budget Ag Decision Maker

How Do Net Income And Operating Cash Flow Differ

Cash Flow Vs Profit What S The Difference Hbs Online

Price To Cash Flow Formula Example Calculate P Cf Ratio

Differences Between Ebitda And Operating Cash Flow Meaden Moore

Introduction To Financial Statements Cash Flow Statement The Kaplan Group

Operating Cash Flow Ratio Youtube

How To Do A Cash Flow Analysis With Examples Lendingtree

Efficacy Of The Dividend Cushion Ratio

2 Briefly Explain On The Importance Of The Chegg Com

What Is Free Cash Flow And Why Is It Important Example And Formula Article

The Value At Risk Earnings Quality Analysis Operating Cash Flow To Net Income

:max_bytes(150000):strip_icc()/ScreenShot2021-04-23at3.37.12PM-ca618e00bdd3459d8a2244b056a7cdeb.png)